ADME

The Aptus Drawdown -Managed Equity ETF Fact Sheet

What is Aptus Drawdown-Managed Equity trying to solve?

Top Ten Holdings as of 08/31/2022 Historically, a small group of big winners have comprised most of each year’s market gains. Rather than diluting with hundreds of mediocre holdings, we prefer to own 50-75 of our favorite large-cap equities. We build from a Yield + Growth framework, tilting holdings to favor companies with solid fundamentals and reasonable valuations while avoiding those with negative price momentum. We believe there’s an upside to less downside behaviorally and mathematically. Rather than try to time the markets, we actively manage index puts in an effort to reduce drawdown and volatility. We build a portfolio that attempts to capture market upside, with a fraction of downside.

Fund Performance (%) as of 8/31/22

Inception Date 06/08/2016

The performance data represents past performance & does not guarantee future results. Investment return & principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost when sold or redeemed. Current performance may be higher or lower than the performance quoted. Returns for periods greater than one year are annualized. Short term performance in particular is not a good indication of the fund’s future performance and an investment should not be made based solely on returns. For performance data current to the most recent month end, please call (251) 517-7198, or visit www.aptusetfs.com

Top Ten Holdings as of 8/31/22

Aptus Drawdown-Managed Equity Characteristics

The Aptus Drawdown-Managed Equity strategy typically selects 50-75 large U.S. companies based on a Yield plus Growth framework, filtering candidates on dividend yield, growth outlook, valuation, and price momentum. The strategy has an added objective of capital protection through the use of equity and index options to reduce drawdown when U.S. equity markets are falling.

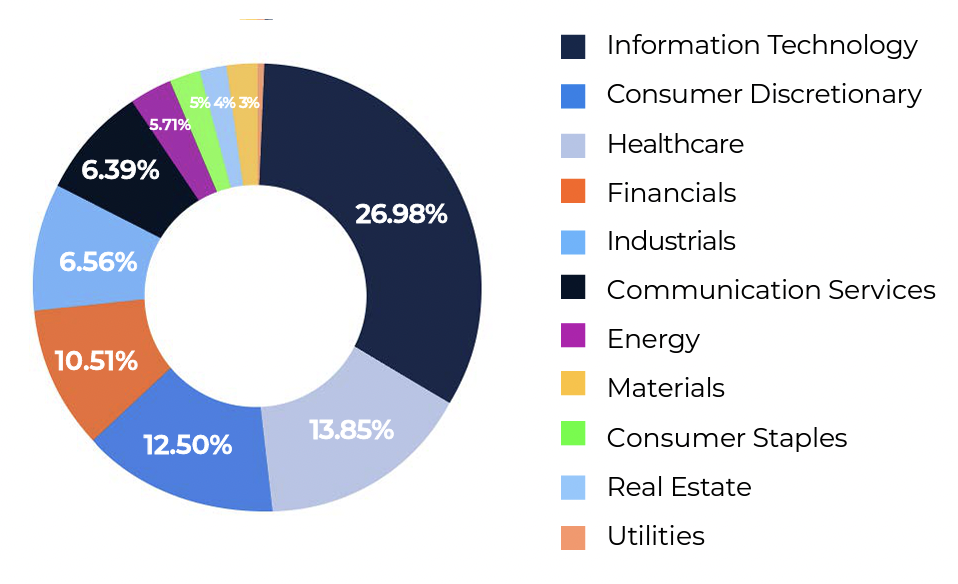

ADME Weights as of 08/31/22

Fund Disclosures

Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security.

Investing in ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value(“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Funds ability to sell its shares.

Shares of any ETF are bought and sold at Market Price(not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Market returns are based upon the midpoint of the bid/ask spread at 4:00pm Eastern Time(when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times.

Aptus Capital Advisors, LLC serves as the investment advisor to the Aptus Funds. Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. The Funds are distributed by Quasar Distributors LLC , which is not affiliated with Aptus Capital Advisors, LLC. The information provided is not intended for trading purposes, and should not be considered investment advice.

Investing involves risk. Principal loss is possible. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than diversified funds.

Therefore, the Fund is more exposed to individual stock or ETF volatility than diversified funds. The Aptus Drawdown-Managed Equity strategy is subject to the risk that the securities may be more volatile than the market as a whole. The Fund may invest in other investment companies and ETFs which may result in higher and duplicative expenses.

The Funds may invest in options, the Funds risk losing all or part of the cash paid (premium) for purchasing options. Call options give the owner the right to buy the underlying security at the specified price within a specific time period. Put options give the owner the right to sell the underlying security at the specified price within a specific time period. Because the Fund only purchases options, the Fund’s losses from its exposure to options is limited to the amount of premiums paid.

Included in the options purchases is a Tail Hedge, designed to mitigate the Fund’s exposure to significant declines in the broader U.S. equity market. There is a risk that the Fund will experience a loss as a result of engaging in such options transactions. The Tail Hedge will not protect against declines in the value of the Fund’s portfolio where such declines are based on factors other than general stock market fluctuations.

Please carefully consider the funds objectives, risks, charges, and expenses before investing. The statutory or summary prospectus contains this and other important information about the investment company. For more information, or a copy of the full or summary prospectus, visit www.aptusetfs.com, or call (251) 517-7198. Read carefully before investing.