UPSD

APTUS LARGE CAP UPSIDE ETF

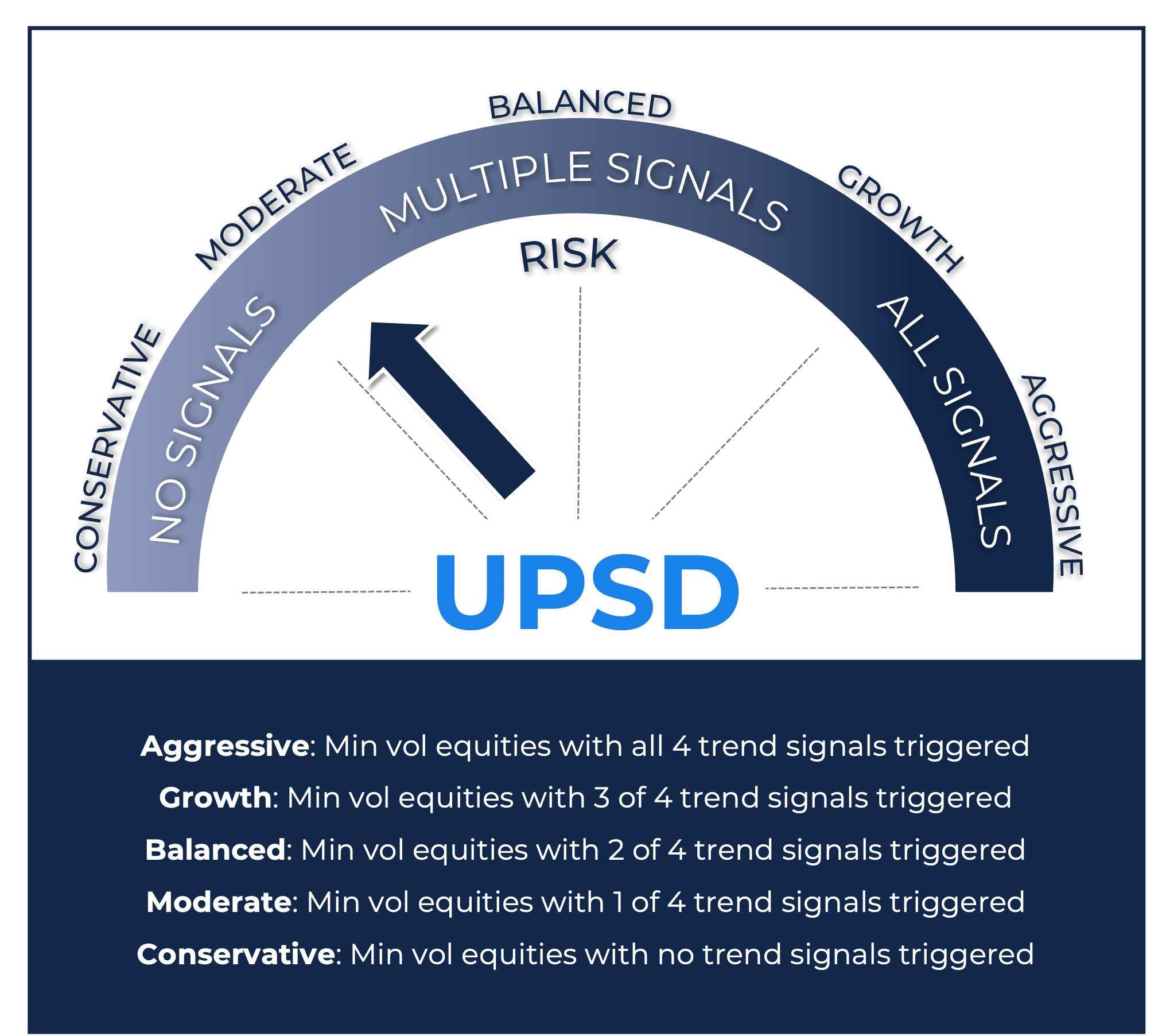

An actively managed ETF designed to enhance risk-adjusted returns by capturing additional upside in favorable market conditions while maintaining a long-term risk profile similar to core U.S. equity portfolios. UPSD uses a disciplined, adaptive approach that increases market exposure during uptrends and manages risk during downturns.

Why UPSD?

Enhanced Upside Potential

Seeks to outperform traditional equity portfolios in strong markets by strategically increasing market exposure beyond 100% when conditions are favorable.

Current UPSD Positioning

Risk-Managed Equity Exposure

Built on a foundation of large-cap U.S. stocks selected for quality, value, and growth, weighted to reduce volatility and optimize returns.

Dynamic Market Adaptation

Adjusts exposure based on market conditions, increasing exposure in uptrends and reducing risk during heightened periods of volatility.

Fund Details

Current as of 05/06/2025

| Fund Ticker | UPSD |

| Fund Name | Aptus Large Cap Upside ETF |

| Primary Exchange | Cboe |

| CUSIP | 26922B444 |

| ISIN | US26922B4445 |

| Net Assets | 44,393,167.69 |

| Expense Ratio | 0.79% |

| 30 Day Median Bid- Ask % | 0.27 |

| Inception Date | 11/20/2024 |

| Shares Outstanding | 1,950,000.00 |

| Distributor | Quasar Distributors |

| Advisor | Aptus Capital Advisors |

*The Systematic Equity Futures Trend and Dynamic PutWrite Series 1 and its data (collectively, the ‘Index’) are provided ‘AS IS’ and ‘AS AVAILABLE’ without warranty or liability of any kind, whether express or implied, and no copying or distribution is permitted. The Index owner and its third party data providers make no representation or warranty, express or implied, regarding the advisability of investing in any products that utilize the Index, and does not sponsor, promote, issue, sell or otherwise recommend or endorse any products utilizing the Index. Index owner expressly disclaims all liability for any special, punitive, direct, indirect or consequential damage even if notified of the possibility of such damages.

**Premium Discount Disclaimer

The following Frequency Distribution of Premiums and Discounts chart is provided to show the frequency at which the closing price of the Fund was at a premium (above) or discount (below) to their daily net asset value (NAV). The chart represents past performance and cannot be used to predict future results. Shareholders may pay more than NAV when buying Fund shares and receive less than NAV when those shares are sold because shares are bought and sold at current market prices.

Fund Objectives

Fund Prices

Current as of 05/06/2025

| NAV | MARKET PRICE | ||

| Net Asset Value | 22.77 | Closing Price | 22.82 |

| Daily Change $ | -0.11 | Daily Change $ | -0.06 |

| Daily Change % | -0.47 | Daily Change % | -0.26 |

| Premium/Discount % | 0.24 |

Fund Distributions

| EX-DATE | RECORD DATE | PAYABLE DATE | INCOME | SHORT TERM CAPITAL GAIN | LONG TERM CAPITAL GAIN |

|---|---|---|---|---|---|

| 03/28/25 | 03/28/25 | 03/31/25 | $0.0427 | ||

| 12/30/24 | 12/30/24 | 12/31/24 | $0.0142 |

This fund is expected to pay at least one more distribution before year end. The figures represent estimates and are subject to change based on portfolio, market, and shareholder activity and tax adjustments. Actual distributions will be based on shares outstanding as of the record date. The net asset value of a fund with a distribution will drop on the ex-date by the amount of the distribution. Keep in mind that market conditions, portfolio changes and/or changes in outstanding fund shares could affect these estimates substantially. This information is NOT FINAL and is subject to change until the ex-dividend date. All data subject to change. Actual distributions will be posted on the aptusetfs.com site after each fund’s ex-dividend date. Aptus does not provide tax, accounting or legal advice. Any tax statements contained herein were not intended or written to be used, and cannot be used for the purpose of avoiding U.S., federal, state or local tax penalties. Clients should consult their advisor as to any tax, accounting or legal statements made herein. Specific questions regarding your clients’ personal income tax situation should be referred to a tax advisor.

Fund Performance

| Monthly as of 04/30/2025 |

Quarterly as of 03/31/2025 |

|||

| NAV % | Market % | NAV % | Market % | |

| 1 Month | -1.91 | -1.97 | -6.98 | -6.56 |

| 3 Month | -8.24 | -8.17 | -3.41 | -2.93 |

| 1 Year | - | - | - | - |

| 3 Year | - | - | - | - |

| 5 Year | - | - | - | - |

| YTD | -5.25 | -4.84 | -3.41 | -2.93 |

| Since Inception | -9.24 | -8.96 | -7.47 | -7.13 |

| Since Inception Annualized | - | - | - | - |

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Short-term performance in particular is not a good indication of the fund’s future performance and an investment should not be made solely on returns.

Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.

NAV: The dollar value of a single share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day.

UPSD Fund Holdings

Current as of 05/06/2025

| Stock Ticker | Cusip | Security Name | Shares | Price | Market Value | Notional Value | Weightings | Effective Date |

|---|---|---|---|---|---|---|---|---|

| 912797PE1 | 912797PE1 | United States Treasury Bill 07/17/2025 | 3,800,000.00 | 99.18 | 3,768,966.65 | - | 8.44% | 05/08/2025 |

| AAPL | 037833100 | Apple Inc | 10,079.00 | 196.25 | 1,978,003.75 | - | 4.43% | 05/08/2025 |

| ABBV | 00287Y109 | AbbVie Inc | 2,992.00 | 188.09 | 562,765.28 | - | 1.26% | 05/08/2025 |

| ABNB | 009066101 | Airbnb Inc | 1,476.00 | 123.12 | 181,725.12 | - | 0.41% | 05/08/2025 |

| ACGL | G0450A105 | Arch Capital Group Ltd | 4,229.00 | 92.69 | 391,986.01 | - | 0.88% | 05/08/2025 |

| ADP | 053015103 | Automatic Data Processing Inc | 1,564.00 | 305.18 | 477,301.52 | - | 1.07% | 05/08/2025 |

| AJG | 363576109 | Arthur J Gallagher & Co | 1,264.00 | 339.55 | 429,191.20 | - | 0.96% | 05/08/2025 |

| AMZN | 023135106 | Amazon.com Inc | 4,714.00 | 188.71 | 889,578.94 | - | 1.99% | 05/08/2025 |

| BMY | 110122108 | Bristol-Myers Squibb Co | 4,583.00 | 47.62 | 218,242.46 | - | 0.49% | 05/08/2025 |

| BR | 11133T103 | Broadridge Financial Solutions Inc | 1,483.00 | 236.19 | 350,269.77 | - | 0.78% | 05/08/2025 |

| CB | H1467J104 | Chubb Ltd | 1,672.00 | 290.43 | 485,598.96 | - | 1.09% | 05/08/2025 |

| CBOE | 12503M108 | Cboe Global Markets Inc | 2,547.00 | 234.23 | 596,583.81 | - | 1.34% | 05/08/2025 |

| CHD | 171340102 | Church & Dwight Co Inc | 3,575.00 | 91.99 | 328,864.25 | - | 0.74% | 05/08/2025 |

| CI | 125523100 | Cigna Group/The | 602.00 | 334.44 | 201,332.88 | - | 0.45% | 05/08/2025 |

| CL | 194162103 | Colgate-Palmolive Co | 6,483.00 | 90.88 | 589,175.04 | - | 1.32% | 05/08/2025 |

| CLX | 189054109 | Clorox Co/The | 2,754.00 | 136.48 | 375,865.92 | - | 0.84% | 05/08/2025 |

| CME | 12572Q105 | CME Group Inc | 2,160.00 | 284.82 | 615,211.20 | - | 1.38% | 05/08/2025 |

| CMG | 169656105 | Chipotle Mexican Grill Inc | 7,216.00 | 51.64 | 372,634.24 | - | 0.83% | 05/08/2025 |

| CNC | 15135B101 | Centene Corp | 5,731.00 | 62.92 | 360,594.52 | - | 0.81% | 05/08/2025 |

| COR | 03073E105 | Cencora Inc | 2,543.00 | 304.58 | 774,546.94 | - | 1.73% | 05/08/2025 |

| COST | 22160K105 | Costco Wholesale Corp | 368.00 | 1,007.15 | 370,631.20 | - | 0.83% | 05/08/2025 |

| CSCO | 17275R102 | Cisco Systems Inc | 4,909.00 | 59.57 | 292,429.13 | - | 0.65% | 05/08/2025 |

| CTAS | 172908105 | Cintas Corp | 1,142.00 | 215.11 | 245,655.62 | - | 0.55% | 05/08/2025 |

| DDOG | 23804L103 | Datadog Inc | 2,942.00 | 106.02 | 311,910.84 | - | 0.70% | 05/08/2025 |

| DG | 256677105 | Dollar General Corp | 3,149.00 | 92.89 | 292,510.61 | - | 0.65% | 05/08/2025 |

| EA | 285512109 | Electronic Arts Inc | 1,300.00 | 155.50 | 202,150.00 | - | 0.45% | 05/08/2025 |

| ELV | 036752103 | ELEVANCE HEALTH INC | 434.00 | 417.43 | 181,164.62 | - | 0.41% | 05/08/2025 |

| ETR | 29364G103 | Entergy Corp | 3,515.00 | 84.24 | 296,103.60 | - | 0.66% | 05/08/2025 |

| EXPE | 30212P303 | Expedia Group Inc | 1,168.00 | 166.56 | 194,542.08 | - | 0.44% | 05/08/2025 |

| FAST | 311900104 | Fastenal Co | 3,485.00 | 78.50 | 273,572.50 | - | 0.61% | 05/08/2025 |

| FI | 337738108 | Fiserv Inc | 1,710.00 | 182.19 | 311,544.90 | - | 0.70% | 05/08/2025 |

| FTNT | 34959E109 | Fortinet Inc | 2,953.00 | 106.72 | 315,144.16 | - | 0.71% | 05/08/2025 |

| GD | 369550108 | General Dynamics Corp | 1,169.00 | 269.45 | 314,987.05 | - | 0.71% | 05/08/2025 |

| GILD | 375558103 | Gilead Sciences Inc | 2,795.00 | 98.90 | 276,425.50 | - | 0.62% | 05/08/2025 |

| GOOG | 02079K107 | Alphabet Inc | 2,174.00 | 152.80 | 332,187.20 | - | 0.74% | 05/08/2025 |

| GOOGL | 02079K305 | Alphabet Inc | 2,279.00 | 151.38 | 344,995.02 | - | 0.77% | 05/08/2025 |

| GRMN | H2906T109 | Garmin Ltd | 914.00 | 188.26 | 172,069.64 | - | 0.39% | 05/08/2025 |

| GWW | 384802104 | WW Grainger Inc | 349.00 | 1,043.74 | 364,265.26 | - | 0.82% | 05/08/2025 |

| HD | 437076102 | Home Depot Inc/The | 773.00 | 362.75 | 280,405.75 | - | 0.63% | 05/08/2025 |

| HIG | 416515104 | Hartford Insurance Group Inc/The | 2,668.00 | 127.78 | 340,917.04 | - | 0.76% | 05/08/2025 |

| HON | 438516106 | Honeywell International Inc | 957.00 | 214.61 | 205,381.77 | - | 0.46% | 05/08/2025 |

| HSY | 427866108 | Hershey Co/The | 2,615.00 | 168.67 | 441,072.05 | - | 0.99% | 05/08/2025 |

| IRM | 46284V101 | Iron Mountain Inc | 2,426.00 | 97.31 | 236,074.06 | - | 0.53% | 05/08/2025 |

| JNJ | 478160104 | Johnson & Johnson | 2,657.00 | 157.30 | 417,946.10 | - | 0.94% | 05/08/2025 |

| K | 487836108 | Kellanova | 7,303.00 | 82.56 | 602,935.68 | - | 1.35% | 05/08/2025 |

| KMB | 494368103 | Kimberly-Clark Corp | 4,057.00 | 133.59 | 541,974.63 | - | 1.21% | 05/08/2025 |

| KO | 191216100 | Coca-Cola Co/The | 8,583.00 | 72.40 | 621,409.20 | - | 1.39% | 05/08/2025 |

| LDOS | 525327102 | Leidos Holdings Inc | 2,901.00 | 154.72 | 448,842.72 | - | 1.00% | 05/08/2025 |

| LIN | G54950103 | Linde PLC | 689.00 | 449.66 | 309,815.74 | - | 0.69% | 05/08/2025 |

| LLY | 532457108 | Eli Lilly & Co | 425.00 | 776.72 | 330,106.00 | - | 0.74% | 05/08/2025 |

| LMT | 539830109 | Lockheed Martin Corp | 1,406.00 | 471.32 | 662,675.92 | - | 1.48% | 05/08/2025 |

| LNG | 16411R208 | Cheniere Energy Inc | 1,641.00 | 238.76 | 391,805.16 | - | 0.88% | 05/08/2025 |

| LYV | 538034109 | Live Nation Entertainment Inc | 1,370.00 | 134.13 | 183,758.10 | - | 0.41% | 05/08/2025 |

| MA | 57636Q104 | Mastercard Inc | 711.00 | 566.33 | 402,660.63 | - | 0.90% | 05/08/2025 |

| MCK | 58155Q103 | McKesson Corp | 613.00 | 722.37 | 442,812.81 | - | 0.99% | 05/08/2025 |

| MELI | 58733R102 | MercadoLibre Inc | 201.00 | 2,262.09 | 454,680.09 | - | 1.02% | 05/08/2025 |

| META | 30303M102 | Meta Platforms Inc | 626.00 | 596.81 | 373,603.06 | - | 0.84% | 05/08/2025 |

| MMC | 571748102 | Marsh & McLennan Cos Inc | 2,093.00 | 227.91 | 477,015.63 | - | 1.07% | 05/08/2025 |

| MNST | 61174X109 | Monster Beverage Corp | 5,413.00 | 60.56 | 327,811.28 | - | 0.73% | 05/08/2025 |

| MO | 02209S103 | Altria Group Inc | 4,665.00 | 60.91 | 284,145.15 | - | 0.64% | 05/08/2025 |

| MPC | 56585A102 | Marathon Petroleum Corp | 3,164.00 | 144.69 | 457,799.16 | - | 1.02% | 05/08/2025 |

| MRK | 58933Y105 | Merck & Co Inc | 4,760.00 | 79.12 | 376,611.20 | - | 0.84% | 05/08/2025 |

| MSFT | 594918104 | Microsoft Corp | 5,022.00 | 433.35 | 2,176,283.70 | - | 4.87% | 05/08/2025 |

| MSI | 620076307 | Motorola Solutions Inc | 1,171.00 | 415.15 | 486,140.65 | - | 1.09% | 05/08/2025 |

| NFLX | 64110L106 | Netflix Inc | 428.00 | 1,155.41 | 494,515.48 | - | 1.11% | 05/08/2025 |

| NOW | 81762P102 | ServiceNow Inc | 580.00 | 983.29 | 570,308.20 | - | 1.28% | 05/08/2025 |

| NVDA | 67066G104 | NVIDIA Corp | 15,701.00 | 117.06 | 1,837,959.06 | - | 4.11% | 05/08/2025 |

| ORCL | 68389X105 | Oracle Corp | 3,764.00 | 149.37 | 562,228.68 | - | 1.26% | 05/08/2025 |

| PANW | 697435105 | Palo Alto Networks Inc | 1,586.00 | 188.14 | 298,390.04 | - | 0.67% | 05/08/2025 |

| PAYX | 704326107 | Paychex Inc | 2,725.00 | 150.32 | 409,622.00 | - | 0.92% | 05/08/2025 |

| PEP | 713448108 | PepsiCo Inc | 3,401.00 | 131.92 | 448,642.92 | - | 1.00% | 05/08/2025 |

| PG | 742718109 | Procter & Gamble Co/The | 2,765.00 | 159.29 | 440,436.85 | - | 0.99% | 05/08/2025 |

| PGR | 743315103 | Progressive Corp/The | 1,929.00 | 286.38 | 552,427.02 | - | 1.24% | 05/08/2025 |

| PM | 718172109 | Philip Morris International Inc | 2,358.00 | 175.36 | 413,498.88 | - | 0.93% | 05/08/2025 |

| PPL | 69351T106 | PPL Corp | 10,415.00 | 36.33 | 378,376.95 | - | 0.85% | 05/08/2025 |

| RCXTSOA6 TRS 012626 | RCXTSOA6 TRS 012626 | RCXTSOA6 TRS 012626 | 232,884.00 | 124.55 | -1,394,268.93 | 29,005,702.20 | -3.12% | 05/08/2025 |

| RCXTSOA6 TRS 090826 | RCXTSOA6 TRS 090826 | RCXTSOA6 TRS 090826 | 111,089.00 | 124.55 | -663,869.86 | 13,836,134.95 | -1.49% | 05/08/2025 |

| RKT | 77311W101 | Rocket Cos Inc | 32,257.00 | 11.62 | 374,826.34 | - | 0.84% | 05/08/2025 |

| ROL | 775711104 | Rollins Inc | 7,676.00 | 56.91 | 436,841.16 | - | 0.98% | 05/08/2025 |

| RPRX | G7709Q104 | Royalty Pharma PLC | 6,524.00 | 32.75 | 213,661.00 | - | 0.48% | 05/08/2025 |

| RSG | 760759100 | Republic Services Inc | 2,011.00 | 251.81 | 506,389.91 | - | 1.13% | 05/08/2025 |

| SHW | 824348106 | Sherwin-Williams Co/The | 788.00 | 351.58 | 277,045.04 | - | 0.62% | 05/08/2025 |

| SPOT | L8681T102 | Spotify Technology SA | 493.00 | 657.10 | 323,950.30 | - | 0.73% | 05/08/2025 |

| SYY | 871829107 | Sysco Corp | 6,412.00 | 70.51 | 452,110.12 | - | 1.01% | 05/08/2025 |

| T | 00206R102 | AT&T Inc | 16,547.00 | 28.10 | 464,970.70 | - | 1.04% | 05/08/2025 |

| TJX | 872540109 | TJX Cos Inc/The | 3,461.00 | 128.65 | 445,257.65 | - | 1.00% | 05/08/2025 |

| TRV | 89417E109 | Travelers Cos Inc/The | 1,292.00 | 268.86 | 347,367.12 | - | 0.78% | 05/08/2025 |

| TSCO | 892356106 | Tractor Supply Co | 5,363.00 | 50.96 | 273,298.48 | - | 0.61% | 05/08/2025 |

| TT | G8994E103 | Trane Technologies PLC | 841.00 | 407.24 | 342,488.84 | - | 0.77% | 05/08/2025 |

| ULTA | 90384S303 | ULTA BEAUTY INC | 530.00 | 392.66 | 208,109.80 | - | 0.47% | 05/08/2025 |

| UNH | 91324P102 | UnitedHealth Group Inc | 824.00 | 391.06 | 322,233.44 | - | 0.72% | 05/08/2025 |

| V | 92826C839 | Visa Inc | 1,180.00 | 349.85 | 412,823.00 | - | 0.92% | 05/08/2025 |

| VEEV | 922475108 | Veeva Systems Inc | 936.00 | 238.32 | 223,067.52 | - | 0.50% | 05/08/2025 |

| VRSK | 92345Y106 | Verisk Analytics Inc | 1,949.00 | 309.90 | 603,995.10 | - | 1.35% | 05/08/2025 |

| VRTX | 92532F100 | Vertex Pharmaceuticals Inc | 731.00 | 434.82 | 317,853.42 | - | 0.71% | 05/08/2025 |

| WAB | 929740108 | Westinghouse Air Brake Technologies Corp | 1,039.00 | 189.70 | 197,098.30 | - | 0.44% | 05/08/2025 |

| WDAY | 98138H101 | Workday Inc | 949.00 | 250.58 | 237,800.42 | - | 0.53% | 05/08/2025 |

| WELL | 95040Q104 | Welltower Inc | 2,216.00 | 151.34 | 335,369.44 | - | 0.75% | 05/08/2025 |

| WM | 94106L109 | Waste Management Inc | 2,192.00 | 235.51 | 516,237.92 | - | 1.16% | 05/08/2025 |

| WMB | 969457100 | Williams Cos Inc/The | 5,462.00 | 58.94 | 321,930.28 | - | 0.72% | 05/08/2025 |

| WMG | 934550203 | Warner Music Group Corp | 9,919.00 | 30.09 | 298,462.71 | - | 0.67% | 05/08/2025 |

| WMT | 931142103 | Walmart Inc | 2,863.00 | 98.83 | 282,950.29 | - | 0.63% | 05/08/2025 |

| WRB | 084423102 | W R Berkley Corp | 8,002.00 | 73.08 | 584,786.16 | - | 1.31% | 05/08/2025 |

| XOM | 30231G102 | Exxon Mobil Corp | 2,776.00 | 104.61 | 290,397.36 | - | 0.65% | 05/08/2025 |

| Cash&Other | Cash&Other | Cash & Other | -614,975.47 | 1.00 | -614,975.47 | - | -1.38% | 05/08/2025 |

Holdings are subject to change without notice.

The Systematic Swap Series is a rules-based strategy that follows a systematic trading strategy that will add/subtract risk based on proprietary signals. The index is made up of S&P Index options and futures.